UK SME’s or MiniMultinationals going global can provide an incredible route to rapid sales growth. However, when UK exporters trade internationally, working capital issues due to long payment term can arise.

What Are Export Loans?

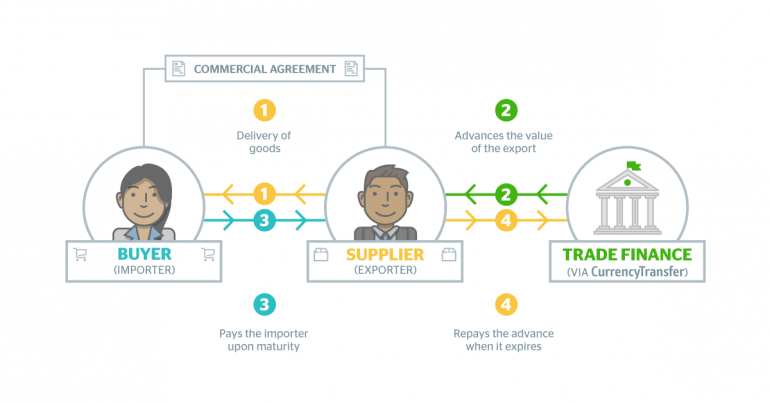

Banks and other financial entities are willing to lend money to exporters as part of an agreement to act on the exporter’s behalf when it comes to collecting payment. An exporter is lent money based on their existing accounts receivable, so that they can continue to build relationships with new importers and source goods, regardless of when or how they receive payment.

Who Needs Export Finance & Global Trade Loans?

SME Exporters across industries: Small and medium-sized exporters require international trade finance. For these companies, it’s more important to quickly establish financing relationships to prevent a stifling in cash flow. A growing UK exporter will have to produce, ship and deliver goods, with these up front costs providing cash flow considerations.

Commodities:

Commodities Finance is the funding of trade in commodities, normally focused on energy, metals and mining, and soft commodities. Dealing in low-margin commodities trading and an absence of trust will likely require export finance as a part of one’s business strategy. It’s difficult to maintain the cash flows required to be constantly sourcing commodities like oil or agricultural products, while also juggling payment terms with importers and trading counterparties. Commodities has typically been tough to provide trade financing, requiring sector specialist lenders due to the heightened risk profile (volatility, low margins, trust).

eCommerce:

eCommerce companies in the B2B arena face seasonal fluctuations and will typically require export finance. eTailers can typically be middlemen that have created a simple online interface for their customers. They must source goods from their own country and fulfill orders streaming in daily for these products, and can therefore find better balance by factoring their invoices or availing of other types of export finance. Trade finance can be put together for UK exporters both against current stock or against the order book. Getting specialist e-commerce export finance will enable you to identify the product catalogue and quantities against the anticipated client demands.

Benefits of Export Loans

- Win a greater number of export contracts

- Ability to fulfill contracts

- Bridge trust barriers

- Optimize cash flows

- Scale quickly and frictionlessly

UK SMEs that focus on exporting goods abroad have a hard time dealing with their importer trading counterparties, simply because it’s hard to establish trust. Importers only want to pay for goods when they arrive, so that their own cash flows remain strong and grant more leeway with their own buyers. Meanwhile, an exporter based in the UK is not readily wanting to send out the shipment of valuable goods without receiving payment. This standoff means that the party conceding to the other’s payment demands must take on extra risk.

Export loans bridge the gap between the receipt of goods and the receipt of payment for exporters. With a bank or other financial institution willing to act as the debt collector, it can pay the exporter immediately for their goods and then retrieve the money from the importer’s bank. The importer’s bank will require proof that the goods have been sent, such as a bill of lading that indicates the shipment is on the way.

For exporters, this extra breathing room accomplishes much. Instead of remaining strapped for cash while the importer offloads the goods and repays on their own timeline, an exporter can continue supplying or manufacturing goods without worry over their short-term solvency. Furthermore, an exporter can concurrently foster and service other relationships in global commerce. Essentially, this means that it’s easier to scale a business.

Lending Requirements For Export Finance

An example of export finance could be a cash advance, assisting a UK exporter with the manufacturing of products purpose built for export. It’s usually referred to when there is a flow of goods internationally or within a country to the end customer. It’s typically a seller side transaction and banks or non-bank providers of export finance credit would want to know:

- Balance sheet, assets and liabilities, and other critical company financial details

- Revenues and profits forecast

- Credit reports

- Existing international trade relationships and documentation

- Personal information about the business owner, CEO and beneficial owners

Though banks usually consider trade and export finance on case-by-case basis with varying needs from borrowers, the above information is commonly requested and should be already prepared when walking into a meeting. It isn’t mandatory for an exporter to seek financing options from a bank, however, with an increasing roster of non-bank export finance options.

Non-Bank Export Loan Providers

1) Export Credit Agency:

There are private and semi-governmental agencies that facilitate a business’ access to financing for export finance purposes

2) Capital Markets:

Sector specialist private equity companies, hedge funds, investment banks and firms are often talk to new export borrowers. They are likely to want to see the same paperwork as a bank, but may have lighter risk parameters.

3) Online:

The internet has democratised the access to export finance, and there is a growing number of FinTech focused, web-based lenders and marketplaces which accomplish export financing for UK companies.

Helping UK Exporters Go Global

Obtaining financing for an exporter is just one step towards building your mini multinational. Getting the cheapest and best export finance deal can be a lifesaver and enabler of your global growth plans.

Finally, factor in the link between securing your export finance transaction and business foreign exchange. Banks typically make cross-border payments an expensive task via hidden transfer fees, high spreads and limited currency risk management capabilities. Every day, a growing wave of ambitious exporters are choosing non-bank, FinTech focused alternatives like the CurrencyTransfer.com global payments marketplace for superior exchange rates, a more personalised experience and access to tools that were once only reserved for FTSE100 and large mid-cap international trading companies.