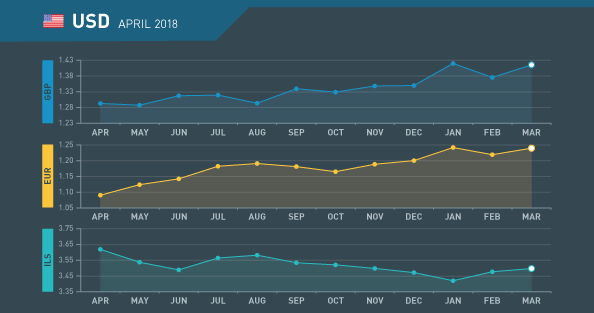

USD Monthly Review April 2018

March in review

Three hike Strategy hits dollar

- Rates hiked but Powell dovish

- Trade war simmering

- Dollar “bumping along the bottom”

Rate hike overshadowed

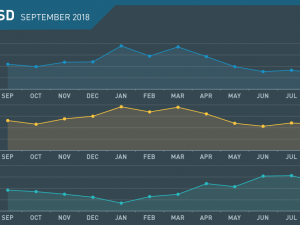

The Federal Reserve hiked interest rates to 1.75% at its latest meeting but the decision was overshadowed by the dovish comments from new Chairman Jerome Powell over the likelihood that the Fed will raise just three times in 2018. The market had been expecting four hikes and the dollar consequently weakened

Trade war bubbling under

President Trump launched a scathing attack on Chinese trade policies as he levied tariffs on several Chinese exports to the U.S. His new Economic advisor Larry Kudlow, also called for China to cooperate more in cutting its trade deficit with the U.S.

Dollar index unable to rally through 91.00

The dollar index has made almost exactly the same high in both February and March as it faces headwinds over trade and interest rates. Having embarked on a programme of interest rate hikes since it turned to a tightening bias, the Fed has been unable to follow through as traders would have expected leading to a confused market a little support for the greenback.

April what to watch

Trade issues could escalate

- China offers talks first

- Growth and employment to drive rate views

- Mid-terms set to drive political concern

China considering its response

The Chinese Premier and chief architect of its economic policy, Li Keqiang was conciliatory in his response to President Trump’s tirade over trade offering talks to discuss opening Chinese markets to U.S. goods. It is certain that if Trump persists he will receive at least a stinging response which will create risk aversion and boost safe-haven currencies.

Four hikes possibly not dead, just stunned

Being the pragmatist he is, Fed Chairman Powell has left the door open for the Fed to change its three-hike strategy to four hikes. Despite his dovish maiden press conference, Powell will also be data dependent so if the March employment report is appreciably stronger than currently expected and inflation rallies, the dollar will react positively expecting three to become four.

Mid-terms to provide political interest

With mid-term elections due to be held this year, the political heat is starting to be turned up under several major issues. At the top of the list is sure to be gun control as President Trump maintains an underlying position but “sways in the political breeze.” With economic activity picking up, Trump will point to every positive item he can find to claim responsibility.

April 2018 : Key Events

Monday

- Final Manufacturing PMI

- ISM Manufacturing PMI

- ISM Manufacturing Prices

Tuesday

- IBD/TIPP Economic Optimism

Wednesday

- Final Services PMI

- ISM Non-Manufacturing PMI

- Factory Orders m/m

Thursday

- ADP Non-Farm Employment

- Trade Balance

Friday

- Average Hourly Earnings m/m

- Non-Farm Employment Change

Tuesday

- PPI m/m

- Core PPI m/m

Wednesday

- CPI m/m

- Core CPI m/m

- FOMC Meeting Minutes

- Federal Budget Balance

- Treasury Currency Report

Friday

- Prelim UoM Consumer Sentiment

- Prelim UoM Inflation Expectations

Monday

- Core Retail Sales m/m

- Retail Sales m/m

- Empire State Manufacturing Index

Tuesday

- Building Permits

- Industrial Production m/m

Thursday

- Philly Fed Manufacturing Index

Tuesday

- CB Consumer Confidence

Thursday

- Core Durable Goods Orders m/m

- Durable Goods Orders m/m

- Goods Trade Balance

- Prelim Wholesale Inventories m/m

Friday

- Advance GDP q/q

- Advance GDP Price Index q/q

Monday

- Chicago PMI

- Nationwide HPI m/m

- Prelim GDP q/q

- High Street Lending

- Index of Services 3m/3m