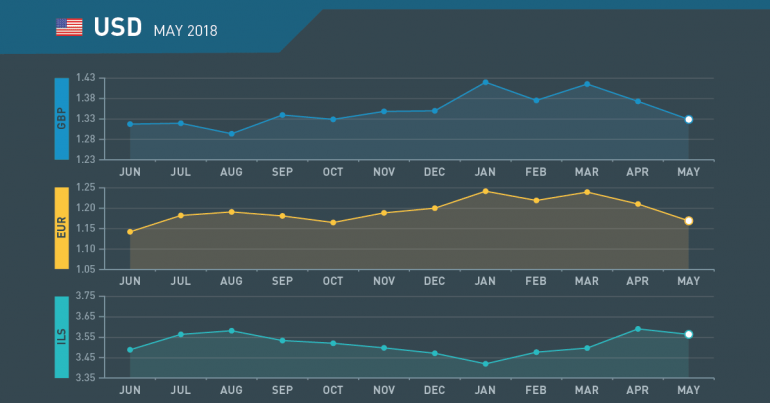

USD Monthly Review June 2018

May in review

FOMC Casts doubt on rate hike

- Ambiguous FOMC creates doubt

- Trump losing control of foreign policy

- Long term yields top out

- Powell defends Fed “independence”

FOMC leaves market guessing

The statement following the most recent FOMC meeting was more hawkish than markets had expected. This gave hope of a rate hike as soon as June. Then the minutes were released, showing a more dovish, reactive stance, lowering hopes a little.

Trump’s foreign policy initiatives losing impetus

Perception can be a powerful driver in politics. When President Trump announced tariffs on Chinese imports and got tough with Pyongyang and Tehran he was (almost) lauded. Since then, China has exerted its own tough stance over trade and influence over North Korea and suddenly Trump has moved from action to reaction, with negative connotations for his policies.

Long-term yields topping out

One of the major drivers of recent dollar strength has been the rise in yield on long-term US Government debt, one of the benchmarks used for housing loans in the U.S. While there is no likelihood they will fall back below 3%, another plank of dollar support has “hit the buffers”.

Fed Chair concerned about independence

Since the financial crisis G7 central banks have been afforded more independence as politicians have been happy to hand over control. Now that rates are starting to rise there is a concern about political influence returning. Fed Chairman Jerome Powell has defended this independence calling for greater transparency despite largely doing away with advance guidance.

June what to watch

Dollar subject to correction

- Wages to provide rate clue

- Trump/Kim back on?

- Q1 growth close to 3%

- Dollar index rally to run out of steam?

Wages data to add to rate jigsaw

It is a testament to the estimation skills of the ONS that they will be able to produce the May employment report on June 1st. There is little possibility of an accurate read of jobs created, but it is wages that will interest analysts. Anything near 3% will raise hopes of an early hike to short term rates.

Trump/Kim back on?

President Trump, struggling to retain control over his proposed summit with Kim Jong-un has now been cast as the secondary influence over events as Kim has gained the upper hand and made it seem Trump is the one keener to meet. This Beijing influenced turn of events will provide some background for the dollar but is unlikely to drive a major reversal.

Q1 growth to improve

The domestic economy is not often a mainstream driver of the dollar unless it involves a rise in short term rates. The infrastructure plans, that have seen a greater level of debt, the twin deficits grow and have led yields higher, are also seeing GDP improve. It is possible that the intermediate release of Q1 GDP will hit 3%.

Index rally coming to an end?

The dollar’s recent rally which has seen many individual drivers is gradually seeing their influence fading. Foreign policy, bond yields and stronger constituent parts could see the index beginning to correct with the first target being 91.80.

June 2018 : Key Events

Friday

- Non-Farm Payrolls

- Average Hourly Earnings

- Unemployment rate

Monday

- Factory Orders

Tuesday

- PMI Services

Wednesday

- Trade Balance

Thursday

- Jobless Claims

Tuesday

- Consumer Price Index

Wednesday

- FOMC Rate Decision

- FOMC Press Conference

Thursday

- Retail Sales

Friday

- Industrial Prodution

Tuesday

- Building Permits

- Housing Starts

Thursday

- Philly Fed Manufacturing Index

- Initial Jobless Claims

- Housing Price Index

Friday

- PMI Services

Wednesday

- Durable Goods Orders

Thursday

- Inidial Jobless Claims

- GDP

Friday

- Core Personal Consumption Expenditure