Highlights

- Yet another reset for the economy

- Housing costs will be the root of any economic malaise

- Calls for an imminent rate cut are growing

Arch hawk to serve another term

Although the Labour Party is avoiding “showing its hand,” due to fears that they will be seen as “more of the same,” Sunak has gained an unfortunate reputation as being something of a “Jonah” for the Party. The more he tries to make changes, the worse the situation becomes.

Although he could be expected to face criticism for the lack of growth and output being achieved, even his two major successes, in lowering both inflation and unemployment, are considered as being the work of others, while there have been several incidents that may have been unexpected but have nonetheless been handled clumsily.

Rumours are swirling around Westminster that members of the Parliamentary Party are considering ditching Sunak since they feel he cannot win the election. In truth, which was the case when he came to power, Tory MPs, particularly those for whom this is their first Parliament, see their careers ending prematurely and are looking for a scapegoat.

The MPC will begin its latest meeting tomorrow with a vote taking place on Thursday, and Andrew Bailey will hold a press conference around lunchtime, most likely to confirm that short-term interest rates will remain at 5.25%, their highest level since February 2008.

Bailey jealously protects the Bank’s independence, but there have been several calls for the make-up of the committee to be changed to allow the views of the independent members to have more effect. Currently, there are four permanent members and four independent members, with Bailey having the casting vote.

In practice, the vote is “skewed” to ensure the Bank’s participants have the “upper hand.”

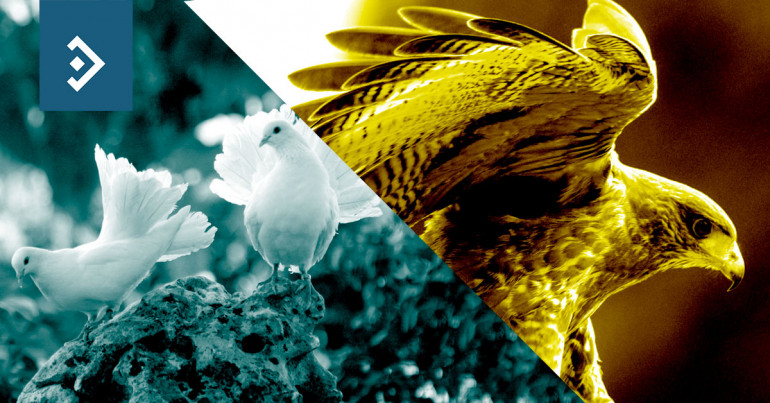

Catherine Mann has been a member of the MPC since September 2021, and yesterday it was confirmed that she will serve a second term. Mann, despite being an American, has a European outlook on the economy, in that she fears inflation primarily. Several times during the period when rates were being increased, she voted for larger incremental increases than were eventually agreed. With hindsight, it may well be that if her view were more seriously considered, inflation would already be close to the Bank’s 2% target.

The latest inflation report will be published, with the headline rate expected to fall from 4% last month to 3.6%. That will be greeted as considerable progress but is unlikely to change the collective minds of the MPC, and rates are expected to remain unchanged.

Andrew Bailey has been seen as being a little more dovish in his comments, and it is expected that he will continue in the same vein on Thursday, He may provide some further advance guidance about the first cut in interest rates, but for now, Sterling will find a degree of support in the fact that rates remain unchanged.

Yesterday, the pound fell to a low of 1.2717 and closed at 1.2746 as the dollar continued to gain due to the market’s anticipation that U.S. interest rates may not be cut until the third quarter.

Rates are unlikely to be cut more than twice this year

The assumption was that, with rates having risen from close to zero to 5.50% in a relatively short period, that their effect on the economy would be severe. Since that has not been the case, the FOMC is entirely justified in leaving rates unchanged to ensure that inflation is defeated.

Jerome Powell has been completely honest in his assessment of the fact that inflation remains too high for the FOMC to consider rate cuts in the short term.

Nonetheless, the market, having seen rates cut over several meetings and then raised as inflation rose, saw the cuts as being little more than a “natural reaction” to the economic cycle.

Unfortunately, while hikes and cuts are the general response from a proactive Central Bank, the economy is like a “living thing” that is constantly evolving and its reaction to such “remedies” is not linear.

Since Powell became Chair of the Fed, he has had to deal with the upheaval that took place following President Biden’s 2019 election victory. That was closely followed by the COVID-19 pandemic that caused a “tidal wave” of fiscal support that saw inflation rise exponentially.

Although he is under constant criticism from Congress, he has “stuck to his guns” in ensuring that rates have been raised and then stayed at an elevated level to ensure that inflation returns to its 2% target.

The only areas of the economy that are struggling currently are real estate and more particularly commercial property rentals. There is a glut developing in the market that has been hastened by the advent of home working. While this was something that had been anticipated given the technological advances that have taken place, the pace of change has left the market ill-prepared.

The dollar index is reacting to the growing belief that it will be some time until the first cut in interest rates takes place. While there are no G7 Central banks that appear keen to cut rates, the Fed is the only one that has the luxury of presiding over an economy that is performing adequately.

Yesterday, the index climbed to a high of 103.65 and closed at 103.58. It faces some degree of resistance at 103.80, but if that can be overcome, it opens the path towards 104.80.

Lower energy costs lead to a record trade surplus

It is difficult to imagine that the German Government remained so short-sighted that it didn’t see its reliance on not just energy, but imported energy being supplied by a potentially hostile nation, as an issue.

Germany has suffered more than its EU neighbours from the energy crisis that unfolded following Russia’s invasion of Ukraine. The fact that the EU does not have a unified defence strategy meant that the stronger nations like Germany and France were left to take the full force of Russian reaction to sanctions.

The German economy is still suffering from the effects of the energy crisis, but they are now abating, leaving the interest rate hikes that have been applied to combat inflation, which, conversely, Germany supports as the major obstacle to recovery.

The fall in energy prices recently while not having a significant effect on the core rate of inflation led to a record trade surplus being achieved last month. While it is technical, in that the volume of imports and exports was barely changed, the cost of imports was significantly lower.

It seems that the only impediment to rate cuts taking place over the next two meetings of the ECB is the level of wage increases throughout the region. There have been several members of the Governing Council who have commented recently that the Bank is preparing for a rate cut.

However, the market has not been prepared for what will happen if wage increases remain well above the inflation rate.

Will the ECB feel it can delay a cut further, and what effect will such a move have on the euro? There must be some “trade-off” between unchanged rates and their effect on the economy. While the Eurozone has managed to stay out of recession so far, any delay in cutting rates by the end of the second quarter will see any meaningful growth being unachievable this year and possibly next.

The euro is now firmly in the thrall of the dollar. Yesterday, it fell to a low of 1.0866 and closed at 1.0872.

Today will see economic surveys for both Germany and the wider Eurozone published. Sentiment has remained weak during the first two months of the year, with the ZEW data continuing to show further declines.

Have a great day!

Exchange rate movements:

18 Mar - 19 Mar 2024

Click on a currency pair to set up a rate alert

Alan Hill

Alan has been involved in the FX market for more than 25 years and brings a wealth of experience to his content. His knowledge has been gained while trading through some of the most volatile periods of recent history. His commentary relies on an understanding of past events and how they will affect future market performance.