BoE struggling to sell inflation story

Morning mid-market rates – The majors

20th August: Highlights

- Majority of small business suffering with supply chain issues

- Dollar riding a wave of expectation

- Two speed recovery brings inflation concerns

Market beginning to see inflation above target through 2022

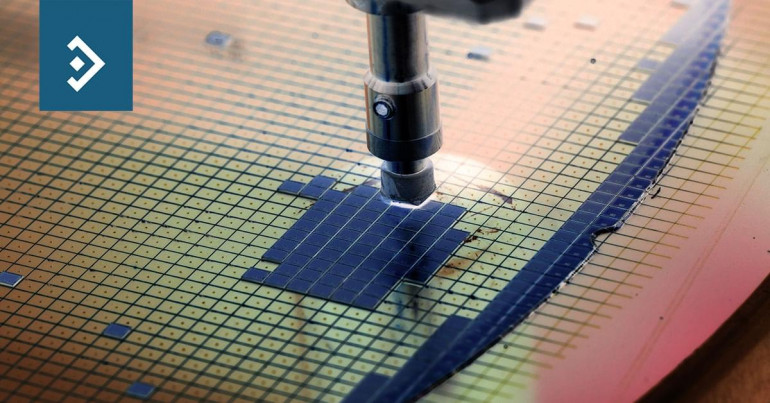

However, while analysts were prepared to take that explanation at face value when it was first used, as time has worn on, questions are being asked about global shortages of raw materials, particularly semi-conductors which are present in just about every device nowadays, shortages of labour and issues around logistics.

In the UK, it is now unclear when the tapering of support will begin. While the assumption remains that the Fed will be the first cab off the rank, it is entirely possible that they could be usurped by the Bank of England, although recent comments from MPC members make the situation more fluid.

It is hard to gauge the mood of the MPC. Are they agreed that the next meeting will address when the tightening will be needed, or are they playing it by ear?

It is accepted that a tightening of policy will occur as the recovery from Coronavirus strengthens, but it is unclear whether there is a consensus about when.

There will always be those who are considered outliers. A prime example is Michael Saunders, who has been hawkish about inflation over the entirety of his tenure and is almost automatically programmed to vote for anything that drives it lower. Maybe he has a Teutonic background.

As time moves forward, the market is beginning to feel that both lower rates and higher inflation will be with us for some time, while the recovery could be subject to something more serious than a bump in the road.

The removal of the furlough scheme has been treated in an abstract manner, something that will happen in the future, but we have bigger issues in the here and now to consider.

Well, those issues have mostly been dealt with and the end of support looms large. The question now is will the recovery be blown off course, causing the Bank to delay removal of support until the New Year? It is already considered fairly certain that any rise in interest rates won’t take place until 2023.

The pound is clinging on versus the dollar, as the Greenback benefits from this week’s FOMC minutes. which seem to make a taper of their support almost certain in the Autumn. It fell to a low of 1.3642 and closed at 1.3640.

Versus the single currency, the pound also fell to a low of 1.1674 and closed at 1.1678.

Considering your next transfer? Log in to compare live quotes today.

Hawkish FOMC minutes push dollar through resistance

There are a couple of caveats that may mean that a continuation of the move higher for the dollar index may not be a one-way street. First, the reaction to the actual withdrawal of support may begin a buy the rumour sell the fact reaction, and comments from FOMC members are likely to be far less hawkish once the withdrawal begins.

The dollar’s rise this week, that has already taken it past its high for the year, may well be warranted against the euro while the ECB continues to appear to be dovish about inflation. However, the UK economy is at least matching that of the U.S. and is certainly ahead in terms of dealing with the delta variant of the Covid-19 virus. This should mean that the fall in the value of Sterling versus the dollar may be more transitory.

There is a clear disconnect between the failings of U.S. foreign policy this week and the outlook for the economy. It seems that both Russia and China have decided to take a backseat for now regarding the shambles in Afghanistan and allow the U.S. to make its own errors.

Weekly jobless claims data was released yesterday and although the most recent numbers have been mixed, the trend is for continued improvement. There were 340k new claims listed over the week to August 14th, this was a new Pandemic era low.

The dollar index has been turbocharged by the most recent FOMC minutes and the fact that the comments made since by members have continued the hawkish tone despite a hiccup in some data.

With inflation appearing to fall, for now, and the prospect of a tightening of monetary policy just around the corner, the dollar has become en-vogue.

Yesterday, it rose to a year’s high of 93.58, closing just a couple of pips lower.

Lagarde determined to continue with support for economy

ECB President Christine Lagarde has used a great deal of skill and diplomacy to push the Bank’s General Council to accept that lower for longer is the correct policy to both assist the Eurozone economy to recover from the Pandemic and also ensure that past mistakes are not repeated.

It is brave of Lagarde to force the Bank to own past policy mistakes, despite the fact that happened before she took over.

This week’s inflation data perfectly illustrated the issues that the Union faces going forward. Eurozone members are seeing a wide range of monthly inflation data, but those EU members outside the single currency are also seeing a similar phenomenon.

This means that consolidated data is almost meaningless and gives the more hawkish Central Banks, within the Eurozone, ammunition to snipe at the majority decision-making process.

In this regard, Lagarde faces an impossible situation.

If the tapering of support ends too soon, a minority portion of the committee will be satisfied if, and it is if, inflation falls in their countries. But that is by no means certain, with labour and logistics issues seeing demand still outstrip supply. However, continued support will lead to heightened inflation, which may or may not be transitory but will provide a platform for continued growth.

It is not a common occurrence in the FX market for the entire market to expect something to happen, which then occurs.

Everyone believed that a break of 1.1700 would see the euro tumble, and that is exactly what happened. The strength of the dollar post-FOMC minutes saw the euro fall to a low of 1.16 65 and closed at 1.1675. While the tumble appears moderate, it signifies a continuation of euro weakness for some time to come.

About Alan Hill

Alan has been involved in the FX market for more than 25 years and brings a wealth of experience to his content. His knowledge has been gained while trading through some of the most volatile periods of recent history. His commentary relies on an understanding of past events and how they will affect future market performance.”