Sterling facing further pressure

Morning mid-market rates – The majors

April 23rd: Highlights

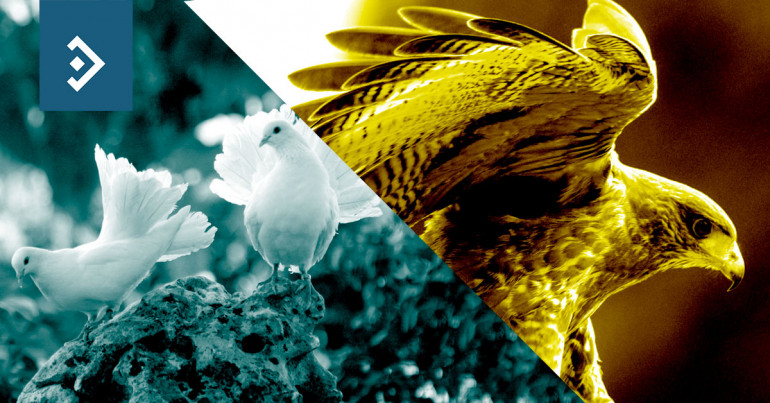

- Rate hopes fading

- Dollar supported by improving risk appetite

- Euro awaits ECB Meeting

MPC hawk considers risks balanced

He agreed that he believed that the pace of rate hikes should be gradual but also that they should not be glacial. He alluded to a belief that the MPC should retain the ability to surprise markets and that traders shouldn’t be too comfortable in their capacity to second guess official decisions.

Last week the pound fell by 2.65% against a strengthening dollar and by close to 2% versus the Euro. Large investment funds have built up substantial long Sterling positions betting not only on a rate hike next month but a bullish view of the economy at the subsequent press conference.

Following poor economic data, a larger than anticipated fall in inflation and rumours of deadlock in Brexit talks over the Irish border issue, the risk is now definitely for a test of the medium-term support at 1.3730.

This week there are only surveys on industrial trends from the Confederation of British Industry to concern traders. They are both expected to be weak partly due lingering concerns over the UK’s departure from the single market and customs union.

Considering your next transfer? Log in to compare live quotes today.

Kim’s pledge boosts dollar

There is still considerable scepticism over Kim’s motives in closing one of three nuclear development and testing sites prior to an impending meeting with Trump but the market is, for now, prepared to “look on the bright side” and has adopted a more positive attitude to the dollar than has been seen in recent weeks.

The dollar index reached a high of 90.47 on Friday just shy of short term resistance at 90.50. It has retained that strength into the start of the Asian week as the Jpy has suffered from the rise in risk appetite.

ising bond yields have also bolstered the dollar as comments from officials of the Federal Reserve alluded to the possibility of more than two more rate hikes this year as the economy starts to expand at a faster rate.

Expectations are already growing for an expansion of wage inflation when the April employment report is released at the end of next week.

Euro awaits ECB Meeting.

With CPI now below 1% the possibility that Sr. Draghi will leave office in November next year never having seen the need to raise interest rates is growing with every meeting. With the French and German Central Bank Heads vying for the opportunity to replace the current President, their support will almost be a vote for or against the continued “steady as she goes” policy.

Jens Weidmann the Bundesbank President will favour a more proactive approach which risks choking off growth in weaker Eurozone economies.

Banque de France Président François Villeroy de Galhau will favour a more expansive stance since his own country’s economy is not yet performing at trend.

The Euro is trading close to medium term support having reached 1.2249 on Friday. Support is seen at 1.2210 with the medium-term trend at 1.2160 where that is a lot of buying interest but traders with long positions are wary of a break of that level.

Have a great day!

About Alan Hill

Alan has been involved in the FX market for more than 25 years and brings a wealth of experience to his content. His knowledge has been gained while trading through some of the most volatile periods of recent history. His commentary relies on an understanding of past events and how they will affect future market performance.”