PM confirms UK will not use force

Morning mid-market rates – The majors

2nd March: Highlights

- Hawkish Saunders wants rate hikes to continue

- Energy issues will weigh on economy, may worry FOMC

- Italy concerned about pace of policy tightening

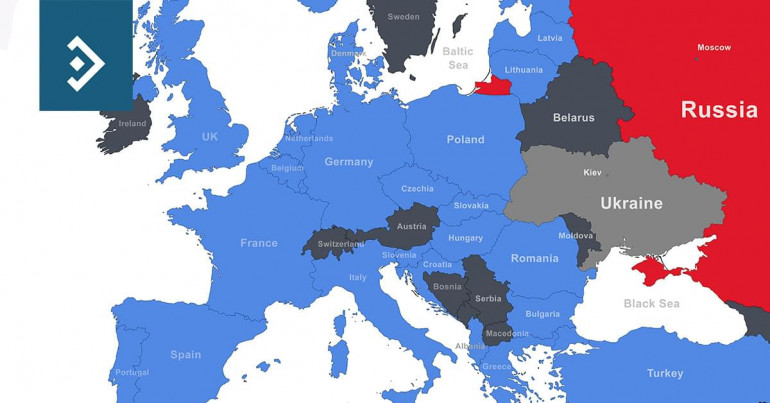

Economic measures will see collapse of Russian economy

In a speech he confirmed that UK troops would stay within the borders of NATO allies and there is no question of them becoming involved in the conflict as it currently stands.

He spoke of his concern that the conflict will lead to a prolonged crisis, and he sees sanctions that are aimed at the Russian economy as being potentially the most telling for Moscow.

Johnson believes that the Russian President’s ambitions for Ukraine will fail as the sanctions begin to bite. The exclusion of Russian banks from the SWIFT payments network will add to concerns about President Putin’s actions at home as it becomes excluded from the international financial community. Johnson wants to ensure that access to the markets is completely removed.

He went on to say that freezing the assets of Putin supporters overseas will begin to turn the tide against Putin locally.

The outflow of refugees from Ukraine will grow steadily and Johnson wants the UK to show that having left the EU it will continue to fulfil its humanitarian responsibilities.

Michael Sunders is a perennially hawkish member of the MPC. He spoke last evening of his despite that the ULK should front load interest rate hikes, as is being discussed in the U.S., to ensure they have the maximum effect on inflation.

Saunders voted for a fifty-basis point hike at the most recent meeting, but he is concerned about the effect of the conflict on the UK economy. He expects inflation to rise, but the hit to incomes may also damage demand. The Bank of England finds itself in a demanding situation, even if it is not alone in facing crucial decisions in the next few months.

Saunders MPC colleague spoke at a separate event. She spoke of her desire to see interest rate rises front loaded to have the maximum effect.

Mann went on to say that the Bank expects wage rises to average around 5% this year, and this is a sign that inflation is becoming embedded in the economy. This needs attention as it could lead the country back into an inflationary spiral.

The pound continues to face pressure from falling risk appetite. Yesterday, it fell to a low of 1.3302, closing at 1.3323.

Considering your next transfer? Log in to compare live quotes today.

Regional Fed Presidents split over rates

One bank put out an economic report yesterday, at which it discussed the possibility that the FOMC could hike by 25bp this month and then by the same amount at every meeting for the rest of the year.

This is highly unlikely, since it would significantly dilute the effect, the hikes would have on lowering inflation.

The odds have fallen that the Fed will hike by 50bp, since they will want to begin cautiously until they have a better understanding of the effect of the conflict in Ukraine on output and growth.

It is difficult to judge how high short-term rates could go, but currently the average estimate is for a terminal rate of 2.25% – 2.50%. This of course depends on how wage negotiations go with workers beginning to demand that pay keeps pace with inflation.

Cleveland Fed President Loretta Mester spoke of the conflict’s likely effect on growth and inflation. She sees GDP taking a 0.5% hit, while inflation will be driven higher by the implications for the energy market.

President Biden delivered the State of the Union address last night. Obviously, his main theme was the conflict in Ukraine and plans to deal with Vladimir Putin.

He fully expects the Federal Reserve to deal with inflation and confirmed his confidence in both Jerome Powell and Lael Brainard.

Despite having become less of a major topic, Biden spoke of his determination to wipe out the fear of Coronavirus, which, he believes, is still a potent threat.

Over the next few days, markets will still be significantly affected by the conflict but the testimony of Jerome Powell to Congress in which he will speak of the Central Bank’s core economic expectations, together with the February Employment Report that is expected to see around 450k new jobs added.

The dollar index continues to gain on the back of falling risk appetite globally. Yesterday it reached a high of 97.57 and closed at 97.39.

Recovery to be significantly affected

The continued rise in energy prices will push inflation higher in several nations, adding to the overall effect on the region, but growth will also be extensively affected.

This is sure to cause further friction between the members of the Governing Council, where the growth versus inflation battle has raged for at least six months.

Lagarde made more hawkish comments than normal at ten most recent meeting but has gradually returned to normal since.

The financial markets have lowered the odd of a hike in rates in the Eurozone this year but have cut the amount by which both the ECB and Bank of England will hike by.

This is a perfect illustration of how the current global economic climate is adding to volatility.

The major concern in Europe is the fear of stagflation. If the thought of rising inflation brings concerns to the Bundesbank, just the mention of the word stagflation will drive the German public close to mass hysteria.

The Governor of the Bank of Portugal, Mario Centeno spoke earlier this week about his belief that the conflict in Ukraine has already delivered stagflation to the region.

Centeno’s comments hark back to the late seventies when inflation was driven into double figures by rising oil prices. It is hard to imagine Russia completely turning off either the gas or oil supply given the state its economy has already fallen into, but the merest hint could send prices twenty or thirty percent higher.

Such a reaction from Russia is not out of the question, since it has a ready market in China, which is continually hungry for energy supplies.

The euro fell to a low of 1.1089 and closed at 1.1130 as volatility continues. The euro is affected by both the fall in global risk appetite and the proximity of the Eurozone to the conflict, although it is almost impossible to envisage a situation where EU troops could become involved without further advances by Russian troops.

About Alan Hill

Alan has been involved in the FX market for more than 25 years and brings a wealth of experience to his content. His knowledge has been gained while trading through some of the most volatile periods of recent history. His commentary relies on an understanding of past events and how they will affect future market performance.”