GBP Monthly Review April 2018

March in review

Brexit Transition Deal Boost

- Further concessions lead to deal

- MPC cool on hike in May at latest meeting

- Inflation falls below incomes

- Corbyn fails to join Russia criticism

Brexit transition to end on 31/12/2020

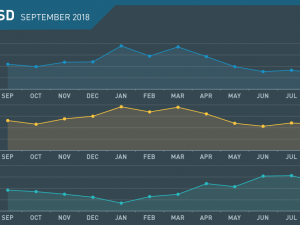

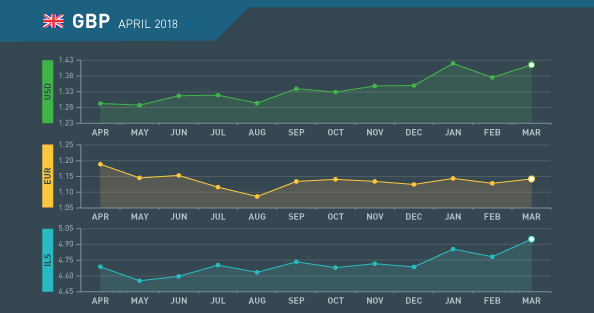

Despite Theresa May wanting a longer transition period, the UK accepted the terms offered by Brussels and the transition period will last just 21 months. Sterling rallied to a high of 1.4346 against the Dollar, but has since begun to correct.

MPC fails to provide rate hike guidance

TThe latest meeting of the MPC saw two members vote for an immediate hike and another call for the committee to be more forward thinking concerning the normalisation of interest rates calling for two hikes a year. The market still sees a 62% chance of a May hike down from 70% in February.

Inflation below incomes

Wages including bonuses rallied strongly in February finally outstripping inflation as cheaper food and petrol brought CPI down. The effect of the Brexit collapse in Sterling has finally “washed through” and the effect of a rallying pound has also brought inflation down.

Corbyn fails to condemn Russia

Jeremy Corbyn, the leader of the opposition, may have dealt his party’s chances of winning the next election a fatal blow as he failed to condemn Russia for it’s alleged use of a nerve agent against a former agent on UK soil. Corbyn was content to say that “the jury is still out” on who was responsible.

April what to watch

Data & Brexit To set Sterling tone

- Irish question set for further revelations

- Further fall in inflation will drive Sterling lower

- Q2 to start with sterling at the top of its range

- Brexit trade talks set to start

Did May agree a deal on the border?

It has been rumoured that Theresa May, the Prime Minister agreed a deal over the Irish border issue as part of the transition negotiations. If that is negative, as it most likely will be, for the North, there could be major fallout.

Inflation data taking on more importance

As inflation rose virtually unchecked and the MPC were willing to place the blame firmly on Sterling weakness, they are going to have to adjust as it starts to fall. Any talk of rate hikes should be wholly dependent on consumer price inflation in the short term as it will take a while for wage inflation to feed through.

Sterling facing differing challenges

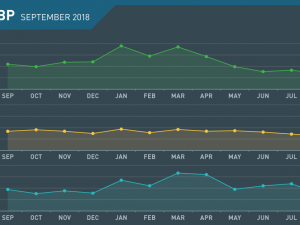

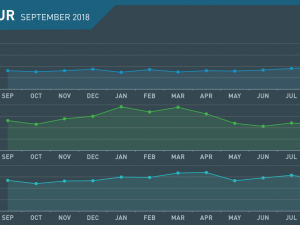

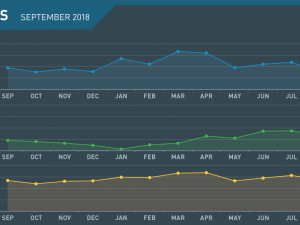

The pound was the market’s “flavour of the month” in March but is unlikely to get such a smooth ride as the issues start to conflict with each other. A rise in the possibility of a rate hike to a probability will be positive. However, if inflation continues to fall, the MPC will be hard pressed to spin a hike. Brexit talks tend to be supportive in their early stages, so it is doubtful that Sterling will move far form a 1.3820/1.4250 range.

Brexit trade talks to commence

Following the capitulation seen in stage one of Brexit and similar actions for the UK Government to ensure a transition was agreed, it seems likely that the trade deal will follow similar lines. As the talks dissolve into “committee stages” it is usual that optimism grows so Sterling may receive a boost from “radio silence.”

April 2018 : Key Events

Monday

- Manufacturing PMI

Tuesday

- Construction PMI

- BRC Shop Price Index y/y

Wednesday

- Services PMI

Thursday

- RICS House Price Balance

Friday

- Housing Equity Withdrawal q/q

Monday

- Halifax HPI m/m

- BRC Retail Sales Monitor y/y

Tuesday

- NIESR GDP Estimate

Wednesday

- Manufacturing Production m/m

- Goods Trade Balance

- Construction Output m/m

- Industrial Production m/m

- 10-y Bond Auction

Thursday

- BOE Credit Conditions Survey

Sunday

- Rightmove HPI m/m

Monday

- CB Leading Index m/m

Tuesday

- CPI y/y

- PPI Input m/m

- RPI y/y

- Core CPI y/y

- HPI y/y

- PPI Output m/m

Wednesday

- Average Earnings Index 3m/y

- Claimant Count Change

- Unemployment Rate

Thursday

- Retail Sales m/m

Monday

- CBI Industrial Order Expectations

Tuesday

- Public Sector Net Borrowing

Thursday

- CBI Realized Sales

- GfK Consumer Confidence

Friday

- Nationwide HPI m/m

- Prelim GDP q/q

- High Street Lending

- Index of Services 3m/3m