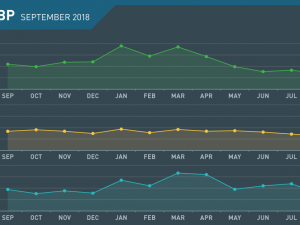

GBP Monthly Review June 2018

May in review

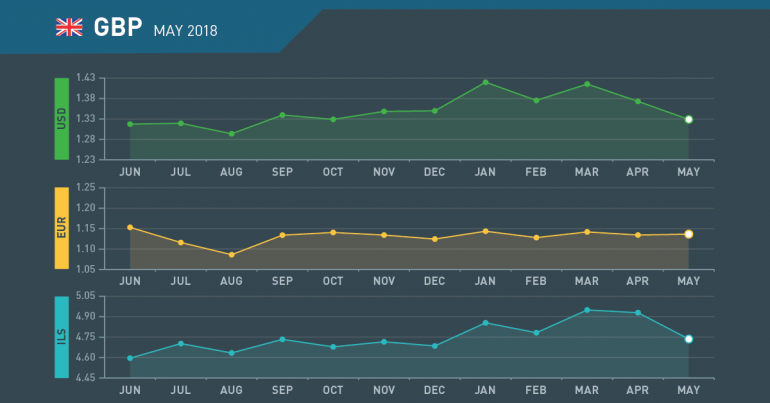

Sterling fall continues

- Rate hike red herring

- Inflation fall continues

- Sterling back to Dec 2017 level

- Growth slumps close to zero

Committee that “cried wolf”

In the period leading up to the MPC meeting early in the month members had been teasing the markets over a rate hike. Governor Carney poured cold water on those rumours and rates were left unchanged as “continuing challenges” were cited.

Inflation at lowest level in a year

The rate of inflation fell to 2.3% (1-yr low) as the Sterling rally, fuelled by rate hike hopes, drove it lower. The subsequent rapid fall in Sterling may see inflation turn higher again.

Sterling gives back gains

The pound fell before & after the MPC meeting as hopes of a rate hike were “kicked down the road” and the economy continued to falter with activity indexes and productivity falling.

GDP barely registers

The UK economy grew at just 0.1% in Q1, just about every indicator turned negative and Brexit fears hit investment. Consumer confidence also fell as house prices and sales activity dropped.

June what to watch

Brexit Proposals due

- Brexit proposals due for release

- Sterling fall could start driving inflation

- Soft data leaves rates on hold

- Pound to threaten major supports

Government to release Brexit proposals

The long-awaited proposals, for the future relationship between London and Brussels post-Brexit, have been promised for early in June. The question of the Irish border will finally be addressed, likely to disappoint the North or South with serious consequences.

Inflation likely to pick up

The rate of inflation, which has been falling for three months is may see a reverse in reaction to the precipitous fall in Sterling and the rise in global oil prices.

Soft data to push rate hikes into 2019

The likely rise in inflation is unlikely to provide any support for Sterling as the fear of stagflation, rising prices and falling economic activity return. Recent PMI indexes have been falling with a reversal unlikely in the current environment.

Pound to threaten 1.3250 and 1.3000

The only saving grace for Sterling could be a turnaround in the Brexit proposals which could bring a soft Brexit and continued membership of the single market. The downside of this could be a rebellion from brexiteers which could eventually lead to an election.

June 2018 : Key Events

Friday

- PMI Manufacturing

Monday

- PMI Construction

Tuesday

- PMI Services

Monday

- Manufacturing Production

- Industrial Production

Tuesday

- Claimant count

- Average Earnings

Wednesday

- Retail Price Index

- Consumer Price Index

Thursday

- Retail Sales

Thursday

- Public Sector Net Borrowing

- BoE Rate Decision

- BoE Minutes

Thursday

- Gfk Consumer Confidence

Friday

- Gross Domestic Product