ILS Monthly Review April 2018

March in review

President marks 70th Anniversary

- Trumps tariffs affecting economy

- Flights through Saudi airspace to develop new markets

- Leverage and private consumption a concern

- ILS in narrow range

Concerns over Trump’ tariffs

There is growing concern that the possibility of a global trade war will affect Israel disproportionally. A relatively small economy like Israel’s should be reasonably well protected but given the percentage of Israeli GDP that comes from exports, the effect of tariffs on exports will be magnified.

New route to bring new markets despite row

The granting of a license to Air India to fly direct to Mumbai through Saudi airspace will open new business opportunities, but has been labelled as discriminatory by El Al who still must go “the long way around”. Whatever the economic cost to El Al any thawing of relations with the largest Arab state must yield economic benefits and new markets.

Bank Leumi concerned over consumption

The level of private consumption and household leverage is starting to cause a concern to Bank Leumi, Israel’s second largest lender. As the main leader in its annual report, the bank said that it had decided not to increase its appetite for consumer debt. This is expected to be the precursor for all banks to reduce levels of exposure to the sector.

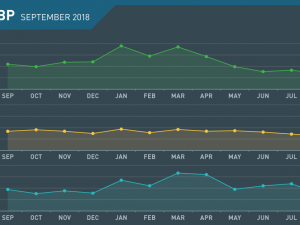

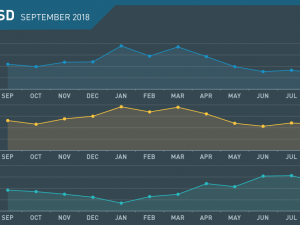

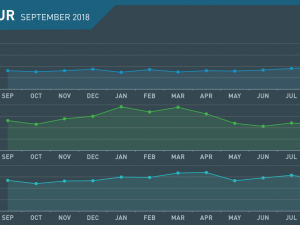

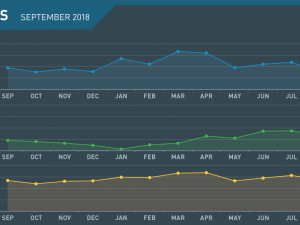

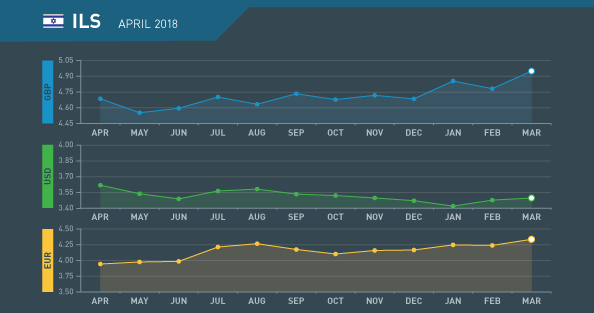

ILS remains in narrow range

The Shekel remained in a narrow range in March despite a certain amount of volatility. It made a low of 3.5075 and a high of 3.4850. In February and March the USD broke a sequence of several months in which it had weakened versus the ILS.

April what to watch

Trump may turn the screw

- Trade war to weaken currency

- Banks to struggle for profitability

- EL Al to continue protest

ILS to suffer if US and China don’t “play nice”

The currency may weaken if the prospects for growth in the economy are affected by tariffs being placed on goods exported from Israel to the U.S. It is beholden upon President Trump to respond to China’s offer of talks to open their markets to U.S. goods which would avert a crisis.

Banks to struggle from self-inflicted restrictions

While prudent the reduction in lending appetite to retail consumers is going to be felt in banks bottom lines. The average increase of 3% last year and by between 6% and 10% by some lenders will be impossible to make up from other sources both in terms of revenue and balance sheet usage.

Direct route to Mumbai to continue to bring angst

The claim by El Al that it is being discriminated by the handing of the first license to fly direct from Tel Aviv to Mumbai over Saudi and Omani airspace is likely to continue. Official representations will be made, but it appears that it will be tough to change the Governments mind.