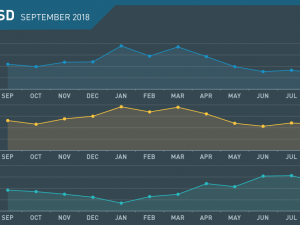

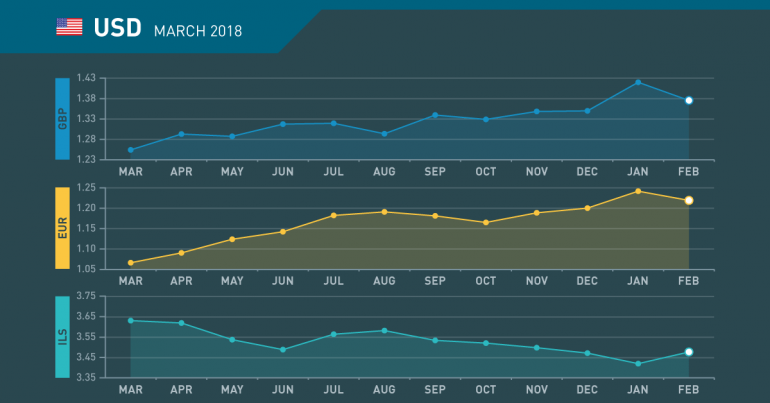

USD Monthly Review March 2018

February in review

Powell continues Yellen Stance

- Rate to rise gradually

- Economy starting to perform well

- Stimulus to be withdrawn over time

- Dollar index remains in range

Powell remains proactive

The new Fed Chair seems to have continued where the old one left off. Proactive rate increases will continue despite concerns that Jerome Powell may be more reactive. Powell’s first congressional testimony contained no surprises and it is clear he will take his time over bringing his influence to bear.

Risks balanced between growth and recession

Powell commented that he was confident that growth in the economy is sustainable and sees no current risk of a slowdown. The risks in the financial sector are moderate and inflation is controlled but prone to an increase as the jobs market tightens.

U.S. economy growth at 3%

The U.S. economy grew at 3% in Q4’17. Inflation remains below the Fed’s 2% target, yet the dollar continues to fall. Strong employment reports are driving hopes for further rate hikes.

Concerns over deficit holding dollar back

The longer-term prospects for the dollar are being hampered by market concerns over the ballooning budget deficit which is set to reach one trillion dollars in 2019. This is due to the recent round of tax cuts and the growth Federal infrastructure spending.

March what to watch

Rate hikes to continue

- Inflation concerns on back burner

- Employment report to bring wages confirmation

- Dollar index to be reactive

- Trump to be dogged by Russian interference

Inflation controlled but likely to rise

Inflation is the major concern for most G7 Central Banks as the global economy improves. The Fed will continue to be the most proactive with at least three hikes slated for this year. The fed will remain proactive despite the New Chairman’s caution.

Late employment report to add to drama

The U.S. employment report will be delayed to March 9th as the Dept. of Labour conjures up a believable estimate. The market will be anxiously awaiting the data for the pace of wage increases since this is the number that started the recent inflation concerns.

Reactive dollar to await employment

Any dollar reaction to the employment report is likely to be short-lived unless there is another major departure from expectation. Wages are likely to have continued to grow at close to 3% which will justify the rate hike profile the Fed has in place.

Trump not out of the woods

There are continued rumblings regarding the influence Russia played over President Trumps election and now he has announced that he will stand again in 2020. Just how that will play out remains to be seen but in the short term congressional hearings continue to hound the President who seems unconcerned.

March 2018 : Key Events

Thursday

- Core PCE Price Index m/m

- Personal Spending m/m

- Fed Chair Powell Testifies

- ISM Manufacturing PMI

Friday

- Revised UoM Consumer Sentiment

Monday

- ISM Non-Manufacturing PMI

Wednesday

- ADP Non-Farm Employment

- Crude Oil Inventories

Friday

- Average Hourly Earnings m/m

- Non-Farm Employment Change

- Unemployment Rate

Tuesday

- CPI m/m

- Core CPI m/m

Wednesday

- Core Retail Sales m/m

- PPI m/m

- Retail Sales m/m

- Core PPI m/m

- Crude Oil Inventories

Thursday

- Empire State Manufacturing Index

- Import Prices m/m

- Philly Fed Manufacturing Index

Friday

- Building Permits

- Capacity Utilization Rate

- Industrial Production m/m

- Prelim UoM Consumer Sentiment

Tuesday

- Current Account

Wednesday

- Existing Home Sales

- Crude Oil Inventories

- Monthly FOMC Meeting

Friday

- Core Durable Goods Orders m/m

- Durable Goods Orders m/m

Tuesday

- CB Consumer Confidence

Wednesday

- Final GDP q/q

- Pending Home Sales m/m

- Crude Oil Inventories

Thursday

- Core PCE Price Index m/m

- Personal Spending m/m

Friday

- Chicago PMI

- Revised UoM Consumer Sentiment