Non-farm payrolls (NFP) is a US employment report, which contains information related to unemployment, job growth, and other key employment statistics. The NFP report is released each month by the Bureau of Labour Statistics.

NFP shows the total number of paid workers in the US, excluding non-profit volunteers, government employees, farm employees, the unincorporated self-employed and unincorporated proprietors.

Why does NFP exclude agriculture?

While agriculture is a major sector in the US, this is excluded from NFP data because:

- Farm employment is highly seasonal

- Accessible technology means farm jobs are decreasing but revenue is unaffected

- Texas, the largest farming state, employs an unknown number of undocumented migrants.

NFP covers about 80% of the workers who contribute to Gross Domestic Product (GDP) and it provides a strong indication over the health of the US economy.

How does NFP affect the US economy?

NFP data plays a large role in US economic policy-making and associated market sentiment. Generally speaking, a higher number of new jobs created is positive for the US economy, but each month, NFP contributes a degree of volatility in several domestic and international markets. The markets most likely to be affected by NFP data are:

- Currency markets – A strong currency is a by-product of a healthy economy. A stronger US economy will attract investment and pump up the value of the USD dollar. This not only affects the value of USD currency pairs but also the economies of those countries who use USD to conduct a large sum of international trade such as China.

- Stock Market Index – A strong dollar can negatively affect US stock market indices such as Dow Jones and the NASDAQ.

Understanding NFP

Like other macroeconomic indices, the Bureau of Labour Statistics publishes NFP after collecting forecasts from banks, private investors, and economists. NFP lists both average and median forecasts drawn from the aforementioned sources.

Predicted forecasts are notoriously inaccurate. In theory, they serve as a tool that, when correct, prevents reactionary swings in the market. More often however, traders capitalise on the disparity between forecasts and actual results, betting on potential price movements that may follow publication of NFP.

Most news sources and analysts will refer to the monthly non-farm payroll report as simply the ‘NFP.’ While we can simplify the data provided into a few aggregate elements it’s important to pay some attention to the individual figures given in subsections of NFP.

Here’s a list of some statistics within NFP that are worth keeping an eye on:

- Sector-specific data – NFP provides information for each of the sectors it monitors. Using NFP data we can see exactly where jobs are being created and where jobs are being lost. se this to help plan future investments.

- Average hourly income – Most treat this statistic as a reflection of the total workforce. If average income were to decrease by 50%, it is reasonable to expect that productivity and output will quickly follow suit as personnel leave the workforce.

- Revisions to previous reports – Markets can suddenly move as traders re-price their growth expectations based on the revisions to previous reports.

How does NFP affect foreign exchange?

There are dozens of indicators that can be examined when considering currency exchange. The Consumer Price Index, Purchasing Managers’ Index, Gross Domestic Product (GDP) Report and Consumer Confidence Index each have the power to alter the currency markets.

Among these various reports, NFP is considered one of the more important because it enables traders to identify trends in economic growth and inflation. When employment increases and unemployment decreases, it’s logical to assume that there will be a greater volume of domestic trade as US households accrue more disposable income.

Domestic trade and household spending have always been a driving factor behind US economic performance. Positive (or negative) sentiment within the market created by NFP data generates momentum, which, in turn, affects forex trading and future market performance.

Looking at each in turn can be time-consuming and impractical, but the influence that NFP has on the currency markets makes it a crucial resource. The information it presents can be turned into actionable strategy,

Most notably, the Federal Reserve uses NFP data as a key consideration for US Monetary Policy and any changes to interest rates, which can be increased or decreased depending on what the data suggests. For more information, click here to learn how inflation can affect currency exchange rates.

Which currency pairs are most affected by NFP data?

NFP pertains to US employment statistics and the general health of the US economy. Therefore, it affects every major USD-currency pairing including (but not limited to) EUR/USD, USD/JPY, GBP/USD, AUD/USD and USD/CHF.

Interestingly, global exchange rates between non-USD pairings will also be affected, some to a greater extent than others. The uncertainty leading up to the release of NFP data can stir volatility among other currency pairings.

CAD, MXN, and RMB often become more volatile as a result of NFP data as Canada, Mexico and China remain the three largest importers of US goods. The increased or decreased output of US exports as a result of US job market performance can have a noticeable knock-on effect in these economies as well as others.

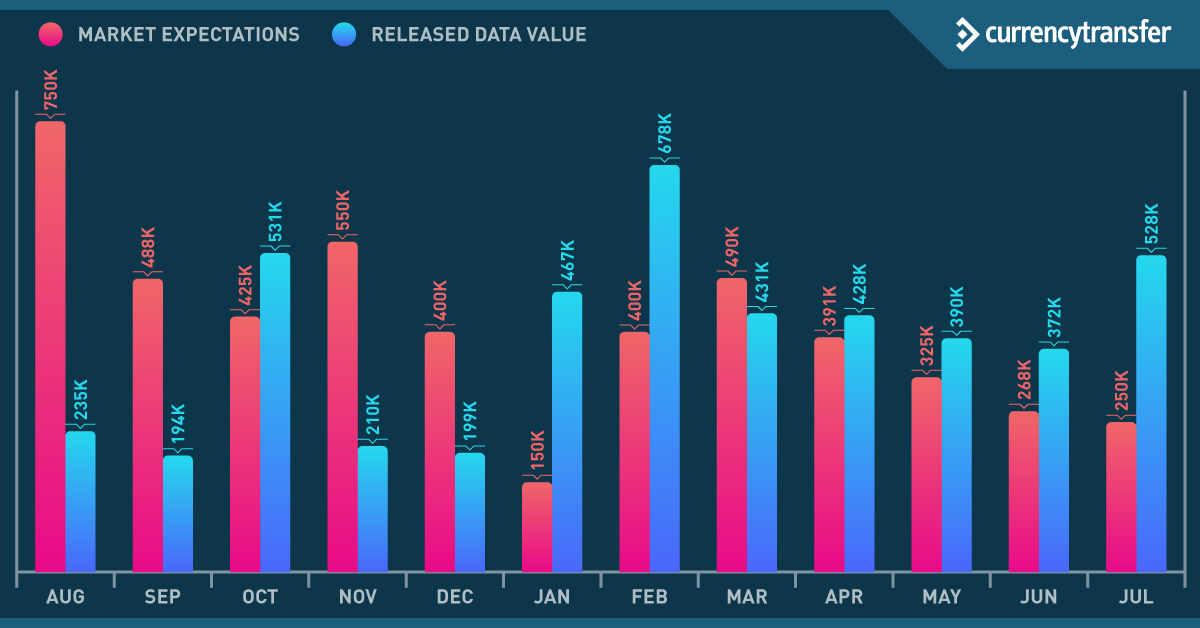

Market expectations vs real data values

Because NFP presents a relatively straightforward set of data, one might assume that it’s safe to make accurate future predictions based on the news.

Fact is, NFP is notoriously inaccurate and hard to predict.

Pay close attention to how many new jobs are created each month and how they compare to estimates. This can help you place the data in context and gauge the general health of the US economy.

The growth of 678,000 new jobs seen in Feb of 2022 is a good sign (by US standards), especially as estimates only predicted a growth of 400,000.

On the other hand, if the estimate was 750,000 and the actual payroll increase is only 235,000, as seen in August of 2021, the resulting negative market sentiments can promote a ‘dovish’ Federal response and trigger a USD sell-off.

Be sure to take note of those statistics provided in the following reports:

- Consumer Price Index (CPI) – The CPI tracks the price of goods bought by consumers and is a reliable tool for tracking currency inflation

- Purchasing Managers’ Index – This monthly survey reflects how business leaders view the economy and how they predict their own future growth potential

- Gross Domestic Product (GDP) – The quarterly GDP report offers a broad assessment of the US economy and influences economic policy decisions as well as market sentiment

- Consumer Confidence Index (CCI) – The CCI measures how willingly consumers spend their money. A lower CCI shows that consumers are uncertain about the future and are choosing to save for a rainy day.

How to manage currency risk with CurrencyTransfer

Market volatility costs SMEs millions of dollars each year. A large number of businesses are exposed to P&L risk, driven by currency volatility. In particular, those companies that deal in USD can see profitability adversely affected by NFP-related market movements.

The CurrencyTransfer recommendation would be to consider hedging your currency exposures. By speaking to our team of Payment Specialists, they can be your eyes and ears in the currency market. By setting up market orders, rate alerts, and booking forward contracts via our Network of FCA regulated payment providers, we can help you significantly reduce your business risk exposures.

No matter what your business or personal requirements are, CurrencyTransfer provides fast, secure and reliable currency exchange services across dozens of currency pairs – helping you assume a risk-averse, secure approach to your payments and financial management.

Matthew Swaile

Copywriter

Florence Couëdel

Editor

Paul Plewman

Editor