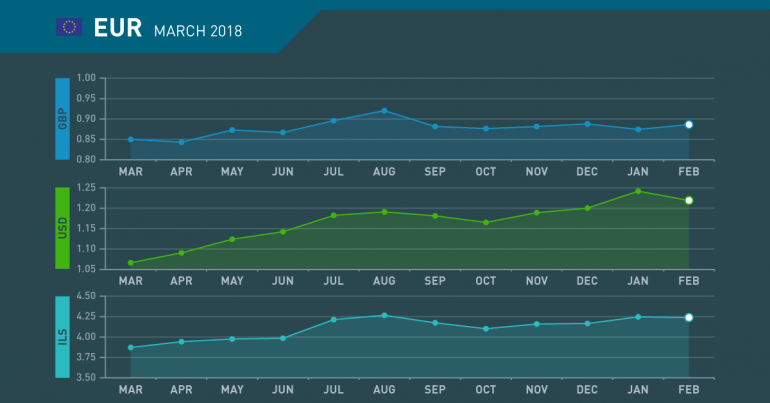

EUR Monthly Review March 2018

February in review

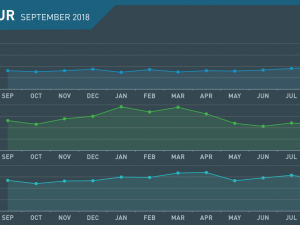

Euro in reactive mode

- Draghi happy to see Euro rangebound

- Inflation under control

- Withdrawal of Asset Purchase Scheme still not likely

- Monetary policy on hold while growth picks up

Euro stops on cue

The single currency reached its medium-term target in February trading a little over 1.2520 but failing to hold onto gains. The subsequent correction will have brought relief to the ECB President who is concerned about currency strength choking off recovery in weaker Eurozone nations.

Inflation remains benign

Much to the surprise of most analysts, inflation is failing to break higher despite growth being seen in the EU economy. Germany is concerned about an overshoot if no action is taken imminently but the ECB believes that any actions can be taken as inflation starts to turn.

Asset Purchase Scheme still providing safety net

Mario Draghi, The ECB President still believes that the weaker economies of the Eurozone require stimulus to ensure that they can stand, at some point, on their own two feet. For now, he feels that the support provided is critical to the economy remaining on track and that any withdrawal is some months away.

Rate hikes still await solid growth data

As well as the Asset Purchase Scheme, monetary policy within the Eurozone will remain on hold until the economy is solid and performing at close to trend. The difficulty the ECB has is how to gauge activity in such a new economy.

March what to watch

Italian election in focus

- Rome Government to have anti-Brussels feel

- Brexit trade proposal to bring clarity

- Euro to react to dollar drivers

- Fight over Draghi replacement beginning

Italian election to rekindle political unrest

Rome is set to have a new coalition Government following Sunday’s election. It is likely to be right leaning and hostile towards Brussels. There is talk of repatriation of immigrants and a new domestic currency which will bring concern to the EU and its supporters.

Brexit talks not only concern to UK

There will be widespread concern across not only Britain and Ireland concerning the outcome of stage two of Brexit talks. There are a significant number of businesses across the whole Eurozone who rely on cross border trade with the UK. As talks get serious the lobby will grow on both sides for a sensible and amicable agreement.

Who will blink first?

The ongoing drivers of the Euro and Dollar seem remarkably similar with inflation the prime concern to both the Fed and the ECB. However, the outlook for the two Central Banks is different with the Fed determines to “stay ahead of the curve” and behave reactively. Both CB’s are acutely aware that despite the inflationary effect of a weaker currency, that their trade position would be aided by such a situation. The euro has been rallying at the expense of the dollar but now the dollar looks set to rally a little.

France making play for ECB Job

Despite already having had their “turn” France is starting to rally in favour of François Villeroy de Galhau as the new President of the ECB when Sr. Draghi retires next year. Germany have been lobbying hard in Favour of the Bundesbank President, Jens Weidmann and the result is sure to be hard fought as talks begin.

March 2018 : Key Events

Friday

- German Retail Sales m/m

- Spanish Unemployment Change

Sunday

- Italian Parliamentary Election

Monday

- Eurozone Services PMI

Tuesday

- Retail PMI

Thursday

- Minimum Bid Rate

- ECB Press Conference

Tuesday

- German ZEW Economic Sentiment

Wednesday

- German CPI m/m

- Eurozone employment change q/q

- Eurozone industrial production

Friday

- Final CPI y/y

Thursday

- French Flash Manufacturing PMI

- French Flash Services PMI

- German Flash Manufacturing PMI

- Flash Manufacturing PMI

- Flash Services PMI

- German Ifo Business Climate

Tuesday

- M3 Money Supply y/y

Wednesday

- Spanish Flash CPI y/y

Thursday

- Eurozone Prelim CPI m/m

Friday

- German Bank Holiday