Security And Regulation

CurrencyTransfer is an online marketplace, matching our customers with the most competitive international payment quotes.

Our company

231 Vauxhall Bridge Road

London SW1V 1AD

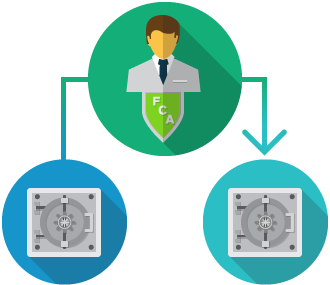

FCA Authorized Payment Institutions

We only stream live exchange rates with foreign exchange suppliers that are supervised by HMRC (Her Majesties Revenue and Customs) and FCA authorized money service businesses. Ensuring the safety and security of your international payments is critical to us.

All our contributing providers follow a strict code to segregate client accounts, and follow 2007 Money Laundering Regulations and other payment services legislation.

Registration with the ICO

Protecting your data is important to us, and we won’t share any of your data with third parties unless you have given us express permission or we are required to do so by the law. To emphasize our commitment to data protection, we have registered with the Information Commissioner’s office.

Facilitating your compliance smoothly

True to our key founding principle, customers can aggregate and book live trades on CurrencyTransfer.com. It’s our USP and secret source. However, in order to make overseas payments you need to have an account with your network currency suppliers.

We make this onboarding process enjoyable, simple and straightforward. Our operational folk at CurrencyTransfer.com have built the world’s first multi-broker compliance and registration form. This means that in order to compare and book trades, you don’t have to bother filling in multiple forms, visiting multiple websites and dealing with multiple compliance people.

We’ve unified the process into one form, to make your life simple. A CurrencyTransfer Exclusive.

APP Fraud

What is an Authorised Push Payment (APP) Scam?

In these scams, fraudsters often create a sense of urgency, pressuring you to act quickly before you have time to properly assess the situation.

At Clear Treasury, we are committed to protecting our clients from fraud. To reinforce this commitment, we strictly adhere to the Payment Systems Regulator’s requirements designed to combat APP scams.

Different Types of Scams

In an invoice or mandate scam, the victim attempts to pay a legitimate invoice, but the criminal intervenes and convinces them to redirect the payment to an account they control. Fraudsters might pose as solicitors, tradespeople, or even business suppliers, often claiming that bank account details have changed. This type of fraud is typically executed by intercepting emails or compromising an email account.

CEO Fraud

CEO fraud occurs when a scammer impersonates a CEO or another high-ranking official within an organisation. The fraudster then attempts to convince you to make an urgent payment to their account. This type of fraud primarily targets businesses, exploiting the authority of the impersonated individual.

Impersonation Scam – Police or Organisations

In this scam, a criminal pretends to be from the police, your bank, or another trusted organisation. They persuade you to make a payment to an account they control, often under the guise of settling a fine, paying overdue tax, or rectifying a refund error. In some cases, the fraudster might ask for remote access to your computer, claiming they need to fix a problem.

Impersonation Scam – Family or Friends

Here, the fraudster pretends to be a family member or someone you know. They then fabricate a story and ask you to transfer money. These requests often come via social media, text messages, or instant messaging platforms, making them seem more genuine.

Purchase Scam

A purchase scam involves paying in advance for goods or services that never materialise. These scams typically take place on online platforms such as auction websites or social media.

Investment Scam

In an investment scam, a criminal convinces you to move your money into a non-existent fund or pay for a fake investment. They often promise high returns on investments in areas such as gold, property, cryptocurrencies, or even land banks.

Romance Scam

Romance scams are initiated through fake profiles on social media or dating sites. The fraudster develops a relationship over time, building trust before claiming to have a problem that requires financial help, such as needing money for a visa or medical bills.

Advance Fee Scam

Advance fee scams involve a criminal convincing you to pay a fee upfront, supposedly to release a larger payment or high-value goods. Scenarios might include winning an overseas lottery, having jewellery held at customs, or being due an inheritance. Once the fee is paid, the promised money or goods never appear. These scams often start with an email or letter.

APP Fraud Reimbursement Scheme

Key points of the scheme include:

The new rules apply to Faster Payments to/from UK relevant accounts

Reimbursement within 5 business days (for most victims) of a report of fraud

Cost sharing between sending and receiving payment firms, with each covering 50% of the reimbursement

When Might We Reimburse You

You have been the victim of an authorised push payment scam

The money which was the subject of the authorised push payment scam was sent from your designated payment account, denominated in GBP.

To a payment account which is denominated in GBP and located in the UK and not controlled by you; and

Via the faster payments system

More details can be found in our Terms of Business

When We Will Not Reimburse You

We determine that you are (a) are party to the fraud; (b) are claiming fraudulently or dishonestly; (c) are claiming for an amount which is the subject of a civil dispute or other civil legal action or which was paid for an unlawful purpose;

The payment was a money remittance payment;

The money subject to the credit transfer is in a currency other than GBP;

The money subject to the credit transfer is sent via a method other than the faster payments scheme;

The money subject to the credit transfer is sent to an account located outside of the UK;

You reported the credit transfer as being as a result of an authorised push payment scam more than 13 months after the payment was executed;

The credit transfer was executed prior to 7 October 2024;

Where we can demonstrate that you have, as a result of gross negligence, not complied with one or more of the requirements set out in the Consumer Standard of Caution, provided that you were not a Vulnerable Customer and this had a material impact on your ability to comply with the Consumer Standard of Caution.

What is the Consumer Standard of Caution?

The Consumer Standard of Caution requires you to:

Have regard to any intervention made by us (including through the confirmation of payee system) and/or any competent national authority (such as the Police or the National Crime Agency);

Upon learning or suspecting that you were the victim of an authorised push payment scam, report it promptly to us;

Respond to any reasonable and proportionate requests for information made by us;

(upon our request) report the scam to the police or consent to us reporting the scam to the police on your behalf

More details can be found in our Terms of Business

Fraud

Reporting fraud

Protecting yourself from fraud

Explore our Fraud FAQs for invaluable insights into fraud prevention, and our Help with Fraud section provides access to reputable organizations for additional support.

Remember, if an offer appears too good to be true, if you’re unexpectedly asked to send money, or if you feel pressured for time, these could be red flags. Reach out to us immediately if you have any concerns – we’re here to assist you every step of the way!

It’s essential to note that we cannot assume responsibility for funds sent to an incorrect account due to fraudulent emails. Always verify payment details received via email from trusted sources to ensure authenticity.

I think I’m the victim of a scam in connection with my account. What do I do?

You can also report fraud to the police via Action Fraud using their on-line reporting tool or by calling 0300 123 2040.

If you’re not based in the UK, inform the police or anti-fraud authorities in your own country.

What can I do to protect myself against fraud?

Keep your personal identification documents, like your passport, securely stored to prevent identity theft. Be cautious about sharing personal details, as they can be misused to open accounts in your name.

Never disclose security question answers or passwords to anyone, and avoid writing them down.

When sending money, always verify bank account details before proceeding with the payment. Obtain the information directly from a trusted source. Access our secure bank details via our online service or app. Consider sending a small test payment first to ensure accuracy.

Prior to purchasing property or investing, verify the legitimacy of the opportunity. Be cautious of enticing brochures, celebrity endorsements, and extravagant promises.

Visit the Take Five to Stop Fraud website for additional advice on scam prevention.

How do I spot someone trying to de-fraud me?

Scams to watch out for

Sending money to friends, family, or romantic partners:

Instances of relationship fraud have surged in recent years. Exercise caution when sending money to individuals you haven’t met in person, particularly if you connected through a dating app. Watch for requests for assistance with medical expenses, housing, or travel costs—are they genuine? Beware of impersonation scams, where you’re asked to send money to a family member supposedly in distress. Always independently verify the situation with that family member to ensure their safety.

Payment for goods or services:

Before making payments, confirm the existence of the goods and the legitimacy of the supplier. Beware of requests for upfront deposits or large fees, as these could indicate an advance fee scam. Check online reviews and obtain an invoice before proceeding. Verify the supplier’s identity, including meeting them in person and confirming a registered business address. Vague contact details, such as only a PO Box and mobile or premium number, should raise concerns about legitimacy.

Settling estate agent, legal fees, or bills:

Fraudsters may intercept payments by sending false invoices or emails with their account details. Ensure the provided account details are genuine and consider sending a small test payment first. This type of fraud is particularly prevalent in the property and real estate sector.

Investing funds:

Be cautious of investments promising exceptionally high returns with low risk—they could be scams. Beware of unsolicited approaches from companies and verify the existence of the investment opportunity. Request identification from brokers and confirm a registered business address. Vague contact details and pressure to invest should raise suspicions. Always check the FCA Register and Warning List for any warnings about the individual or company. Seek advice from an FCA-regulated firm before proceeding.

Where can I get help with fraud?

Take Five

Action Fraud

Which?

National Cyber Security Centre

Metropolitan Police – fraud advice

Security

Password security

Here are our expert tips for crafting ironclad passwords:

Length Matters: Use a minimum of 12 characters. While there’s no strict rule, a length of at least 12-14 characters is generally recommended.

Mix it Up: Incorporate a blend of numbers, symbols, capital letters, and lowercase letters. This complexity adds layers of security against fraudulent software.

Stay Impersonal: Avoid using easily discoverable personal information such as birthdates or pet names. Opt instead for seemingly random words or phrases to thwart potential hackers.

Take Control: Manage your online footprint by reviewing privacy settings on social accounts and being cautious about sharing personal information online.

Get Creative: Think outside the box and concoct unconventional combinations of words, substituting letters with special characters and numbers. The more unique, the better.

Test for Strength: Unsure about your password’s resilience? Use a reliable online checker to gauge its crackability and fine-tune as needed.

Diversify: Resist the urge to reuse passwords across multiple platforms. Using unique passwords minimizes the fallout in case of a breach.

Guard Your Secrets: Never share your password with anyone, and avoid writing it down. Committing it to memory is your best bet.

Stay Vigilant: Set reminders to change your password regularly and never disclose it, even if prompted by seemingly legitimate sources.

Remember, we prioritize your security. We’ll never ask for your password, and if you suspect any compromise, change it immediately through the secure link on our login form. Your online safety is paramount to us.

Computer, mobile and tablet security

Maintain Device Health: Keep your computer safeguarded with active anti-virus software and ensure regular updates for all software and applications. These updates often contain patches addressing potential security vulnerabilities.

Lock Down Your Wi-Fi: Protect your home Wi-Fi network with a robust password. Refer to our password security section for tips on crafting a strong one.

Stay Logged Out: When using a computer that isn’t yours, refrain from selecting the ‘Remember me’ option and always log out once you’ve finished your session.

Exercise Caution in Public: Exercise caution when connecting to public networks, as they are frequently targeted by cybercriminals. Whenever possible, opt for mobile data over public Wi-Fi. If you must use public Wi-Fi, ensure you’re on a trusted network and be vigilant of your surroundings. Avoid accessing secure sites in public spaces to mitigate the risk of shoulder surfing attacks.

Beware of Click Bait: Be wary of suspicious links or pop-ups while browsing the web. Fraudsters often employ enticing offers, threats, or urgent messages to lure unsuspecting users into clicking. If it seems too good to be true or raises suspicion, steer clear.

Choose Security Information Wisely: When selecting security information for accounts, opt for questions with answers only you would know. Avoid using information readily available on social media, as it may be accessible to hackers.

Verify Website Authenticity: When visiting our website, ensure you type the address directly into the search bar or select it from a trusted search engine. Look for indicators of authenticity, such as valid security certificates, correct URLs, and the presence of https:// in the address bar. Additionally, check for the locked padlock symbol, indicating encrypted data transmission between you and the site.

Secure Fund Transfers: Prioritize the legitimacy of recipients and transfer reasons when making overseas payments. Take your time to verify recipient information and never feel pressured into transferring funds if you’re not entirely comfortable with the transaction.

We prioritize your online safety and security. By following these guidelines, you can help safeguard your digital presence from potential threats.

Email security

When it comes to emails from us, it’s essential to exercise caution and verify their authenticity before taking any action. Here are some key points to keep in mind:

Branding Consistency: While our style may evolve, certain elements like our distinctive logo should always be present.

Conflicting Instructions: If you receive conflicting instructions in quick succession, reach out to us for clarification.

Unusual Requests: We never solicit personal details via email, threaten account changes without proper channels, or request login credentials.

Spelling and Grammar: While we’re not immune to occasional typos, extensive errors may indicate a fraudulent email.

Tone Alert: Our communications are never pushy or threatening. Take your time to review and act on emails, as fraudsters often employ scare tactics.

Sender Verification: Our sender’s addresses always end in either ‘@cleartreasury.co.uk’ or ‘@clearcurrency.co.uk’.

Link Caution: Be wary of unexpected email links; it’s safer to manually type our web address or access our services directly.

Attachments Warning: Avoid opening attachments or downloading software from unknown sources, as they could contain malware.

Prize Scams: If you receive a prize claim for an unrecognized competition, verify its authenticity with your account manager or our customer service team.

Golden Rule: Never click on email links or attachments unless you’re certain of their source’s trustworthiness.

When in doubt, always double-check! Your security is our priority. If you have any concerns about an email’s legitimacy, don’t hesitate to reach out for verification.

Telephone and text message security

Before Answering a Call: While most mobile devices are adept at flagging spam calls, fraudsters can manipulate caller IDs to appear genuine. If you have any doubts about a caller’s authenticity, conduct a quick search engine check on the number. Alternatively, if unsure whether a call originates from us, cross-reference it with the number listed in the contact sections of our websites.

Upon Answering: Under no circumstances should you disclose passwords or key security information over the phone, regardless of the caller’s claims. If asked to provide such details or input anything into your keypad, terminate the call immediately.

Exercise Caution with Text Messages: We only send SMS messages for specific purposes, such as One Time Passcodes (OTP) for online account activation. If you receive a text message requesting password replies, calls to unfamiliar numbers, or clicks on links, disregard the message and contact your account manager or our customer services team for validation.

Recognizing Fraudster Tactics: Fraudsters often exploit fear and urgency to manipulate your judgment. Be wary of messages warning about suspicious activity or urging immediate action, especially those claiming ‘an unknown device has accessed your account’. Additionally, remain vigilant against overly helpful or professional language aimed at enhancing credibility. Should you receive a text followed by a phone call, exercise caution as fraudsters commonly employ this tactic to appear genuine.

Your security is paramount. By adhering to these guidelines and staying vigilant, you can better protect yourself against phone and text scams.

Online service and app security

Online Service and App Features:

PIN Entry: At pivotal points during the transfer process, such as adding a recipient, we’ll prompt you to enter a One Time Password (OTP) that we send via SMS. Remember, this OTP is confidential and should never be shared with anyone. Rest assured, our staff will never request this information from you.

Transactional Emails: For every transaction you initiate, we’ll promptly send you an email confirmation. This ensures you have a comprehensive record of all recent activities on your account.

Activity Monitoring: Within both the app and our online service, you have the ability to monitor your recent and historic activities, empowering you with full visibility and control.

We’re committed to providing you with a safe and secure online experience. With these integrated features, you can confidently manage your financial activities while enjoying peace of mind.