EUR Monthly Review May 2018

April in review

Business confidence fading

- ECB continues in dovish mood

- Euro remains within range

- Bad debt overhang remains

- Eurozone still short of complete Monetary Union

ECB continues dovish stance

The ECB remained stoically dovish at its latest meeting with President Draghi continuing to point out the risk to weaker economies of the removal of accommodation. They did not indicate when policy may change, but it is unlikely to be in 2018.!

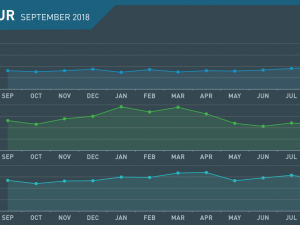

Euro on “well-trod path”

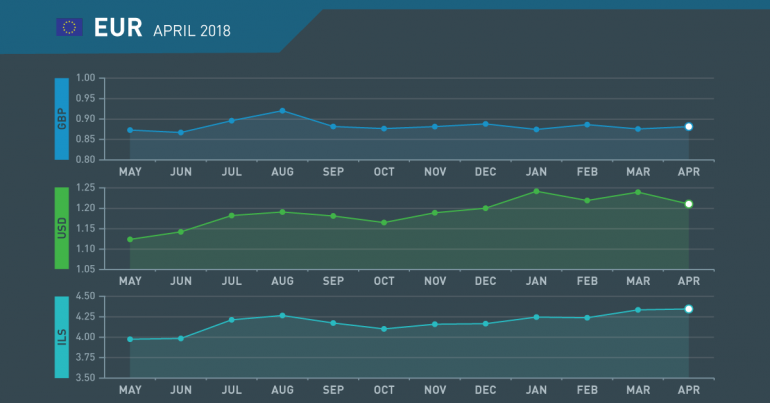

The Euro remains within its medium-term range although it has moved close to its lows during the month, predominantly due to dollar strength. Traders have little expectation of support from the ECB so are content to “trade the range”, looking for good news elsewhere.

Bad debt overhang remains

One of the major concerns going forward for the Eurozone is the volume of bad loans remaining from the financial crisis. Despite Greece and Cyprus having the largest percentage of bad loans, the largest volume in Euro terms are held by French and German banks. This will need to be addressed by the ECB and could slow down economic activity if banks become less inclined to lend.

More work needed on Monetary Union

There is a widespread belief that Eurozone monetary union is complete, but in reality there is still a long way to go on a path strewn with mistrust. For example, a unified deposit insurance scheme is needed, but there are concerns that it will dissuade laggards from compliance as they will be able to rely on those banks/countries that do comply.

May what to watch

Non-Financial issues a Concern

- A campaign to replace Draghi set to begin

- Refugee crisis to raise political temperature

- EU reform plans to be revealed

- Brexit trade concerns to spill over

France and Germany set to lock horns

The credentials of François Villeroy de Galhau and Jens Weidmann are set to become closely aligned to the demands of their respective Central Banks as the campaigning begins for the next ECB President. It may become a clash of doctrine and personality, with Frankfurt likely to play the “it’s our turn” card.

Summer to bring refugee issues

The EU refugee crisis has become something of a seasonal event as the weather improves and more displaced people are prepared to make the hazardous journeys involved. The countries in the East of the region continue to object to the forced quotas being demanded of them and may rebel.

EU reform plans to be revealed

Emmanuel Macron and Angela Merkel are sufficiently secure at home now to push for greater integration within the EU, particularly in the areas of welfare and defence. Their proposals, yet to be fully revealed, could meet with strong resistance from several nations who wish to keep their sovereign status.

Brexit; more than a UK issue

While it is likely that the UK faces the most significant upheaval from Brexit, there are concerns amongst the EU’s larger economies about their potential loss of a lucrative export market. There are moves to ensure that the UK receives more favourable terms that are presently being offered by Brussels.

April 2018 : Key Events

Thursday

- Spanish Unemployment Change

- CPI Flash Estimate y/y

Tuesday

- EU Economic Forecasts

Tuesday

- German Prelim GDP q/q

- Flash GDP q/q

- German ZEW Economic Sentiment

Wednesday

- Final CPI y/y

Thursday

- German Flash Manufacturing PMI

- German Flash Services PMI

- Flash Manufacturing PMI

- Flash Services PMI

Friday

- German Ifo Business Climate

Tuesday

- Spanish Flash CPI y/y

- M3 Money Supply y/y

Wednesday

- German Prelim CPI m/m

Thursday

- CPI Flash Estimate y/y