Welcome to our comprehensive guide to trade finance for ambitious British MiniMultinationals – a topic that can truly unlock the growth potential of ambitious UK SME’s trading internationally.

Trade finance solutions can be crucial component of cross-border trade that helps reduce growth obstacles and avoids key pain points for importers and exporters of goods. Small and medium enterprises (SME’s) must rely on trade finance to better maintain trading relationships without disruption. Access to international trade finance helps CEO’s and Finance Teams deal with complex, inconsistent cash flow, logistical, and financial issues common to the various industries without putting a strain on day-to-day operations. In short, credit facilities can provide flexibility, convenience and security.

What is Trade Finance?

International trade finance deals with financial activities involving global commerce, like lending, insurance, and credit. SME’s may face liquidity issues when business working capital is tied up in inventory, and at the worst case, solvency can become a risk.

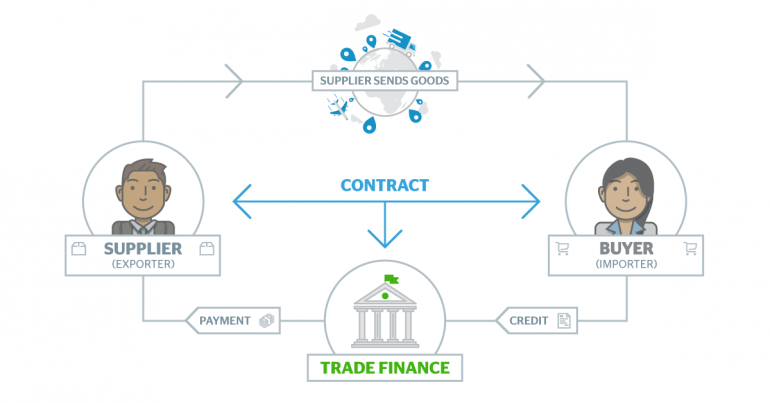

Stakeholders involved in trade finance solutions can provide transparency and accountability to global importers and exporters, being a catalyst for trust. Importers want their suppliers to send goods but need to tackle the challenges of preventing an exporter from taking funds and not fulfilling their end of the deal. On the other side of the equation, an exporter doesn’t want to send goods until they receive payment, out of fear that the importer will receive products and refuse to pay.

Advantages and Disadvantages of Trade Finance

For UK SMEs, the benefits of using trade finance solutions can help propel a mini multinational business to the next level. These include:

- Fast funding and quick decisions from non-Bank FinTech lenders

- A simple way to arrange-short term finance

- Gives businesses flexibility

- Non-bank lenders can offer convenience with no setup or maintenance costs

- Strong control of trade cycles

- Allows business to hone in on growth activity

- Finance is traditionally secured against goods or covered by an insurance policy

Disadvantages of trade finance solutions can include:

- SME’s must prove they have a strong ability to repay

- Possibility of bad debt

- Extending credit needs to be analyzed to provide comfort to sellers on their own cash flows

- SME must ensure they are financially able to commit to trade finance obligations, operationally and financially

- Access to working capital can be very expensive via interest on the loaned amount

What Types of Trade Finance Are There?

Small and medium sized importers and exporters in the UK have several options when considering the most appropriate type of trade finance solution

Trade Finance Loans:

Flexible, short term credit facilities, that are typically linked to import or export transactions. Trade finance loans and credit can be offered by banks or a growing wave of non-bank, FinTech focused lenders. Lenders will want to know a list of business’s assets as collateral.

Letter of Trade Credit:

Imported goods can be bought on letters of credit. Typically offered by a bank, a letter of credit is sent from the importer’s bank to the exporter’s bank and will release payment from the former to the latter automatically, upon receipt of an official document demonstrating that the goods have been shipped. Bills of lading are commonly used to provide this proof. This is conceptually similar to a bank guarantee but specific to international business relationships.

Cash in Advance:

A cash advance is an unsecured payment of funds to the exporter before the goods are shipped – with the importer assuming the risk. For exporters, this method is preferable, but it requires trust from the importer and is usually more common among pre-established trade relationships. This is typically common for internet based businesses and low value orders. An importer in the UK would send cash advances to its suppliers abroad so that friction in the international supply chain is minimized. Business foreign exchange transfers can be complicated and full of friction when paying suppliers abroad, with solutions like CurrencyTransfer.comproviding a more cost-effective, service led and strategic approach to sending money abroad and managing currency volatility.

Open Account:

In these types of international trade transactions, goods are shipped and delivered before payment is owed, typically between 30 and 90 days. This is clearly a win for the importer for the perspective of cash flow and cost, but poses risks to the exporter. Due to aggressive competition in the export markets, foreign buyers can press for these types of open account terms.

Factoring:

An exporting business that is owed money can sell the invoices that they send to importers to a third party, at a slight discount. The third party can collect the amount of the invoice in full, and in turn provides increased liquidity to the exporter.

Trade Credit Insurance:

Exporters that want to protect their accounts receivable (invoices) and ensure that they’re always repaid can obtain trade credit insurance from private or public credit agencies. A policy will guarantee the payment of invoices for goods, even if the importer were to go out of business and default due to bankruptcy.

How to Access International Trade Finance

For SMEs, the issue of trade finance is becoming an increasingly popular option with the rise of globalisation and the speed at which companies can go global. Companies must consider the impact of trade finance on their business’s growth, reach to new markets, and scalability. To obtain any of the trade financing solutions outlined above, an SME must conduct due diligence, shop around and find a financing source that is trustworthy, cost effective and solve the specific need or problem the growing business is looking to address.

For Import Finance or Export Finance, you’ll typically need to provide to a lender:

- Annual accounts and audited statements

- Business plans

- Cash flow forecasts

- Creditor statements

- References on beneficial owners and directors

- Audit of company liabilities

For letters of credit, term loans and open accounts, an SME business will need to go to a bank or private lender specifically focused on the appropriate trade finance need. These are the only entities that can produce the notarized, enforceable documentation necessary. Factoring is typically handled by expert factoring firms, which specialize in these types of financing arrangements. Cash advances can also be handled through a bank, but a wise SME uses a non-bank foreign exchange platform like CurrencyTransfer.com, which accomplishes the same goal of moving money internationally, but more inexpensively and with dedicated relationship management.

Types of Importers and Exporters Needing Trade Finance

As importers and exporters scale up operations, a healthy percentage will need to access trade finance solutions. Exporters require timely payment for their goods and importers need a guarantee that goods will be delivered on time and manage their cash flow. Industries that typically take advantage of import or export finance include:

- Commodities

- Global eTailers & Power Sellers

- Machinery and equipment

- Metals

- Pharmaceuticals

- Plastics

- Optical

- Medical

- Aviation

- Furniture, Bedding, Lighting

More specifically, smaller and medium-sized importers and exporters are users of trade finance due to their greater exposure to market dynamics, and lesser choices should something go wrong. In the UK, changing regulations are also a component of trade finance, and impose stricter controls on funds entering and leaving the country. Newer, smaller startup importers and exporters appreciate this due to the lack of trust that they must tolerate while the business expands into new markets, requires new suppliers, and encounters fresh obstacles.

Relationship Between Trade Finance & Business Foreign Exchange

Smaller importing exporting businesses are relying on more direct methods for maintaining smooth relations with their suppliers abroad. After making a healthy connection with an exporter, these companies are required to make international business payments via services like CurrencyTransfer.com, which provides transparent, inexpensive, digital and fast (even same day) transfers from one currency to another.

Part of the reason for the changing trend is that banks haven’t lowered the cost of their currency exchange and transfer services, spreads are high, and the toolbox available for currency risk management is limited. However, modern payment technology helps importers and exporters avoid fluctuating exchange rates while reducing the cost of the transfer itself as well. Accordingly, services like the global payments marketplace CurrencyTransfer.com are so valued as a key partner for global success.